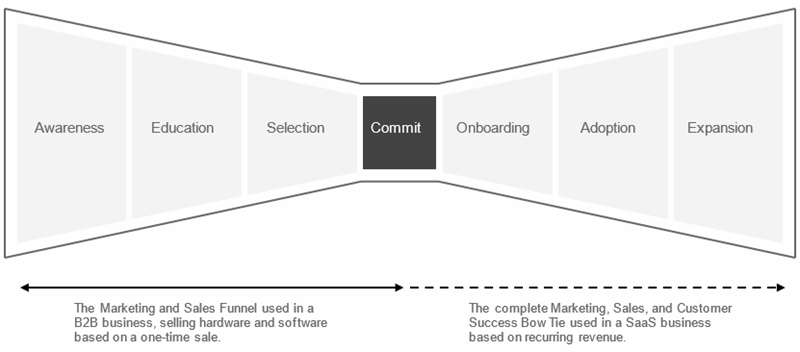

In the previous article, we described how SaaS and recurring revenue growth does not operate within the traditional marketing funnel, but a more complex, bow-tie model.

The Bow Tie model is depicted below. The left side of the bow tie reflects the conventional marketing and sales funnel. But then, instead of ending with a "closed-won," it goes into a state in which both parties—company and customer—mutually commit to achieving beneficial impact.

The Bow Tie data model covers three critical gaps in the traditional marketing funnel:

- In the onboarding stage, aim to achieve the "first impact" the customer seeks.

- In the adoption stage, achieve and report the recurrence of "recurring impact."

- In the expansion stage, identify where you can expand the "impact" beyond the original scope.

Fundamentals of the Recurring Revenue Model

In conventional hardware or perpetual software sales, the customer pays a large portion—if not the lion's share—up front,. That makes the solution profitable in 60-90 days.

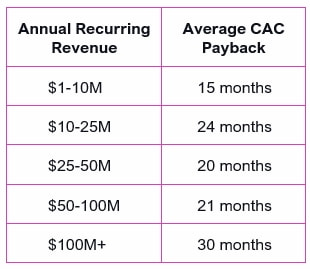

In recurring revenue, as a result of the lower cost, profitability takes a lot longer. It takes, on average, 15-30 months to recoup the customer acquisition cost (CAC) alone, research performed among the Bessemer portfolio of SaaS companies has found.

That length of time is referred to as the CAC Payback, as depicted in the following table.

Source: Scaling to $100M by Bessemer Venture Partners

It is not enough for a company to recoup the investment in the effort to win the deal. A company has to be profitable, and many more months are needed to achieve that.

The length of the customer relationship is referred to as customer lifetime, and the total revenue garnered over the months or years a customer keeps renewing is called lifetime value (LTV, or CLTV). Historically, successful companies have an LTV to CAC ratio of 3:1.

So, if it takes a company 20 months to recoup CAC, the customer needs to renew for 60 months, or five years, for the company to secure enough revenue to run a successful business.

That is a lot longer than most executives think, and it explains the importance of the Bow Tie.

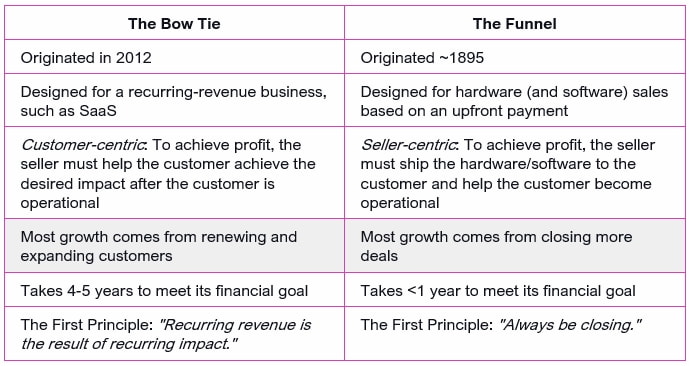

The following table shows a comparison between Bow-Tie-model thinking and marketing-funnel thinking.

When you compare the two models, it becomes clear that they are built on different growth principles at their core:

- The principle of growth from a conventional hardware and software sale is based on a one-off upfront payment, therefore centering the business on producing more new leads and converting them into wins. The marketing and sales funnel captures the acquisition correctly, but the expansion takes place outside the purview of the marketing and sales funnel.

- The principle of growth in a SaaS business is based on months of recurring revenue (renewals) and preferably month-over-month growth (expansion). The Bow Tie captures both the acquisition and the expansion correctly.

The source of the issue is this: Recurring revenue is based on a new First Principle.

The now outdated First Principle was that growth comes from closing more deals. The new First Principle is that growth comes from helping your customers achieve their desired impact. If they do not accomplish that impact, they will churn long before a profit is made.

In other words, the more you sell to customers that don't achieve impact, the more significant your losses are, as you will not recoup your CAC. But also: the more impact you offer, the more revenue you earn, because correctly designed recurring revenue businesses will have their growth continue to compound over the years.

Recurring Revenue Is the Result of Recurring Impact

At this point, it should be clear that achieving impact is essential. The most common impact a SaaS product offers is to lower the cost through some form of automation or to increase revenue by unlocking some new opportunity. We refer to that kind of quantifiable impact as rational impact.

In working with hundreds of companies on impact, however, we discovered early on that there was another kind of impact: In many cases, decisions were not made because the company wanted to increase revenue or decrease the cost but because the decisions appealed to individual user interests, reduced headaches, and made things simpler and easier. Those reasons expose a new kind of impact: emotional impact.

The two kinds of impact, briefly explained:

- Rational Impact: Quantitative and often highly measurable, such as increasing revenue and reducing the result. A hallmark of rational impact is that it benefits the corporation foremost, rather than a person. Rational impact relies on facts, figures, and data—the science of business.

- Emotional Impact: Qualitative and driven by feelings and experiences. Emotional impact benefits the individual person foremost. Unlike rational impact, this plays out in a workplace where people have already decided what they want because of the intuitive user interface (for example) and they are now selling their management team on the rational benefits of the preferred solution.

How Emotional Impact Helps Us Understand Decision-Making

Differentiating between rational and emotional impact helps us explain how decisions are made in a company.

Three fundamental principles of decision-making that are derived from impact can help us shape modern processes around the decision process and the decision criteria.

1. Emotional impact first benefits the person and then helps the company

Rational impact, on the other hand, first benefits a company and then helps a person. For example, when your SaaS service causes a million dollars in savings, the person does not get those savings; the company does. (A benefit may eventually trickle down to the person in the form of a salary increase or job promotion, for example.)

2. Emotional impact varies from person to person.

Each person experiences emotional impact differently. Rational impact, on the other hand, often shows up the same across all those involved in the decision.

For example, everyone in the company is aligned on helping customers increase revenue and decrease costs. But each person involved wants something different: The CFO may want real-time dashboards to make life easier; the head of Operations may wish for automatic data entry to avoid having to work on the weekend; others may just want to use a cool new tool.

3. Most humans make emotional decisions

Humans conclude what they believe is the right solution. They then seek to rationalize that decision with facts and figures. For example, "getting a cool new tool" will not pass budget approval, so the manager instead positions the purchase as "it will save us $1.2M over 3 years."

Traditionally, marketing and sales identify a customer's rational needs and sell the customer the benefits of the product or service.

For example, we all receive emails we immediately recognize as spam when they say "Do this and save money" or "Make more money right now." That strategy overlooks that it is addressing a person, not a corporation. In that example, the company may find more success by presenting emotional impact and sending recipients an article: "The Top 10 Coolest Tools in the Industry."

Next week: How the SPICED framework shows that recurring revenue comes from recurring emotional impact.

More Resources on Recurring Revenue

Eight Subscription Models and Five Best-Practices for Your Offerings

Subscribers, Not Buyers: Five Ways the Shift to Subscription Services Changes Marketing