Fully 66% of ABM programs underperform, ITSMA reports. I contend that many ABM programs fail to deliver significant revenue growth because they are being driven by technology and demand-gen functions. And, in those cases, ABM might as well be a more targeted "demand gen" and "digital advertising" function, using technologies that can be found in the Forrester New Wave for ABM platforms.

Gong Senior ABM Manager Corrina Owens mentioned during her "Less is More" interview on the ABM Done Right Podcast that ABM platforms have diluted the market and obscured what ABM is about. Those platforms' big selling point is the targeted advertising approach, which has become the norm; but many marketers have forgotten the principles of ABM, Owens said.

Marketers need to take a "less is more" approach, she said: focusing less on demand gen and more on "less" accounts, and giving those accounts and the human buyers inside them hyper-personal attention.

When ABM programs are driven by ABM tech and demand-gen functions, they become composed entirely of campaigns and tactics (retargeted ads, emails, outreach campaigns, etc.) to build the pipeline. Even if a huge gap exists between pipeline numbers and revenue, the focus remains on getting leads into the pipeline. There is little focus on influencing buying decisions along the complete buyer's journey.

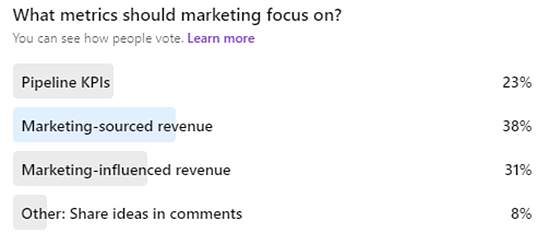

My marketing metrics poll on LinkedIn found that most marketing teams (60%) are focused only on the beginning of the journey, looking at pipeline KPIs and Marketing-sourced revenue.

ABM organizations that focus on pipeline KPIs and Marketing-sourced revenue are doing only account-based lead gen, account-based advertising, account-based awareness, and account-based demand gen.

But ABM should be about how leadership, sales, marketing, revenue, sales enablement, customer success, and product teams together hit the numbers the business needs to get to the next level.

ABM should be a business strategy that focuses on how the teams will fix business challenges that are tied to the fundamentals of revenue: win rates, deal sizes, sales velocity, stage progression, sales cycle time, retention, annually recurring revenue (ARR), margin growth, and expansion.

It should be about improving sales motions, the interactions go-to-market (GTM) teams are having with Tier 1 accounts (the 20% of accounts that can deliver 80% of today's and tomorrow's revenue growth), and the experiences those teams are delivering.

All that goes beyond building a pipeline and using ABM to reach as many prospects as possible within your ideal customer profile (ICP). It requires marketing to make a real impact on the complete buyer's journey and customer lifecycle.

ABM that's driven by ABM tech and demand gen alone will not help GTM teams go upmarket

I recently asked a CMO of a channel sales technology company about her ABM program. She rattled off the technologies she and her team were using: 6sense, Terminus, Xant, Outreach, and others. She mentioned how her company was a case study for 6sense. But the team was just running targeted demand-gen programs with in-market accounts.

While the team was getting traction, it was challenged to win multiyear contracts with accounts that would need a deal size of more than $75K per year. Accounts that large would consistently move forward with what the team considered a safe bet—in other words, Salesforce.

The team members were obviously not teaching for differentiation with content and messaging that shows the impact that competitor-specific gaps would have on the target accounts. They weren't changing the sales and marketing conversation and narrative. They weren't changing the interactions that Sales and Marketing were having with larger accounts.

When talking to the CMO of a cybersecurity and managed detection response firm targeting organizations using Microsoft Defender 365, we learned that the company was engaging only low-value deals with its ABM campaigns. The team was getting only $65K accounts into the pipeline vs. $125-250K.

The problem is the company was simply doing targeted demand gen—engaging only in a personalized one-to-few and one-to-many approach. Its campaigns spoke at targeted accounts and "personas" and focused on general assumptions and pain points. It made its ABM program campaign-based vs. focusing on the interactions that sales and marketing teams needed to have with accounts that can deliver the greatest revenue growth. Sales and marketing teams were pushing out content and messaging and hoping that something stuck. They were still telling "everybody's" story.

ABM that's driven by ABM tech and demand gen alone will not fix stage-progression challenges

A fintech firm serving midmarket banks as well as national institutions such as Wells Fargo was focused on scaling ABM to build a stronger pipeline. Its goal was to increase the number of appointments that Sales was having. But its Stage-One-to-close rate was 5%. And, after losing most of its opportunities right from the beginning, it lost more than half the deals that did progress.

The issue was the teams were doing targeted demand gen, not ABM, which should be about getting key accounts to revenue. Team members relied on technology to put out content and messaging to targeted accounts, but they didn't change sales motions, sales processes, and conversations so they could improve their win rates. They didn't think about how they should be changing the prospect's experience.

The more companies focus on scaling ABM and making it a targeted demand-gen function, the further away they get from having the right interactions and delivering the right experiences.

ABM driven by ABM tech and demand gen alone will not fix long sales cycles

While speaking to an AI tech firm, I learned that its marketing department created engagement with Mastercard and Walmart; but after 14 months of conversations, the firm was still not close to a signed deal. The CMO mentioned that it needed closers. But the CMO was not using ABM to accelerate accounts to revenue; the company was focusing on the top of the funnel vs. using ABM to influence both selling conversations and the internal conversations that Sales was not privy to.

A strategy is needed for accounts that do not engage in your ABM campaigns, accounts that go dark, and accounts that are stuck in their buying journey.

For example, a conversation AI company with deal sizes of $500K+ was challenged with stage progression after sales engagement. Its Demandbase campaigns created demand and built a pipeline, but there was no follow-through. There was no account-based enablement and strategy to ensure wins. Instead of a handshake, there was a hand-off, which meant that ABM was, again, being treated as a targeted demand-gen function.

Demand gen and ABM tech are important pieces of the puzzle

I am not against ABM platforms or demand gen. At Personal ABM, we integrate our personal account-based approach with the one-to-few and one-to-many programs that our clients are executing using ABM platforms.

But all of us need to go beyond the box that many marketers put ABM into and start using ABM to fix the revenue leaks found in many sales and marketing organizations.

More Resources on ABM Strategy

Enterprise ABM: Five Common Pitfalls and Tactics to Avoid Them