Subscription-based services have been around since the turn of the previous century: Think of library memberships, or milkmen providing their goods to their "subscribers" door to door.

Now, the Internet era and the increased efficiency of postal and courier services have led to a boom in companies' using the same B2C subscription-based service business models.

Among the most popular types of subscription service companies are those that ship consumables—replenishable or perishable goods such as cosmetics, food, and drugs. Examples include Blue Apron and Freshly, Birchbox, Dollar Shave Club, and Capsule.

Those companies spend tremendous amounts of resources acquiring customers, offering them signup promos and competitive pricing. But retaining these customers is a whole 'nother challenge. Up to 80% of customers cancel their subscription in the first three months, and up to 15% of those customers renew their subscription only to take advantage of another lucrative promo.

Subscription-based businesses create consumer behavioral patterns that are different from pay-per-product consumer patterns, and marketers must adjust accordingly to focus on increasing longevity by nurturing long-lasting relationship with clients and increasing lifetime value (LTV), rather than impulse or seasonal purchasing.

My company, Optimove, identified common customer personas by looking at the data of various consumable subscription-based companies. This article will offer suggestions on how marketers can effectively engage and retain the personas we uncovered in our research.

1. Promo Abusers

Promo Abusers are customers who took advantage of a signup promo (e.g., $30 off your first box) and canceled their membership right after they paid or after they received the goods.

For subscription services that offer widespread promos for first use, around 85% of customers use that promo. Some of the insights we uncovered about these customers:

- 30-40% of customers who use the signup promo cancel their subscription before making a second payment.

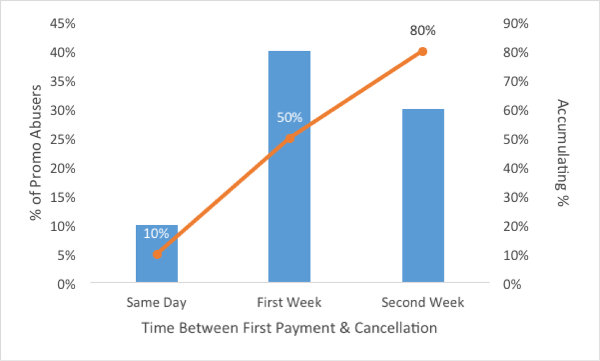

- Out of those customers, 10% will cancel on the same day they made a payment, 50% will cancel in the first week, and 80% will cancel up to two weeks after their first payment.

- Around 10% of all customers who made at least two payments reused the signup promo by creating a new subscription; this segment is 35-45% less valuable than other customers with two or more payments, but their longevity is up to three times longer. However, one-third of these customers will cancel their subscription after using the signup promo and not return.

The Promo Abusers are hard to retain, so it's crucial to identify them at an early phase in their lifecycle.

Most companies validate new users against existing email addresses; but new email addresses are easy to create, leading some customers to create new memberships to take advantage of signup promos. Instead, the validation of new user creation should be conducted against phone number or address, which do not change frequently, thus preventing customers from abusing signup promos.

Subscription providers should also reward their customers for loyalty, especially at an early stage, to encourage them to remain members.

For example, every five consecutive paid orders, send customers a message specifying that they will be rewarded with a discount for the next order (the marketer can add "without skipping weeks\months" for increased gamification).

Another example: focus on that elusive second purchase, by using a popup during the first order encouraging customers to pay for their second shipment straightaway by offering a reward or discount.

2. New Subscribers

New subscribers are recent signups who are yet to become fully familiar with the service. They are in an incubation period in which their opinion is formed, their loyalty to the service is built, and the decision to continue or cut-off the membership is made. Among them...

- Customers who subscribe via friend referral are of lower value and less likely to remain active longer than other customers who used any other kind of signup promo.

- Referred friends, which make up 15-20% of new subscribers, are 33% more likely to become one-timers who cancel their subscription after one order, and they are 60% less valuable in terms of net value.

- Even removing Promo Abusers from the sample, we still see that referrals are 25-33% less valuable, on average.

Naturally, new subscribers who are provided a better experience will remain active members longer. This "experience" can be measured both by analyzing ratings and comments submitted by the subscriber and the overall ratings and comments of the goods that the subscriber ordered.

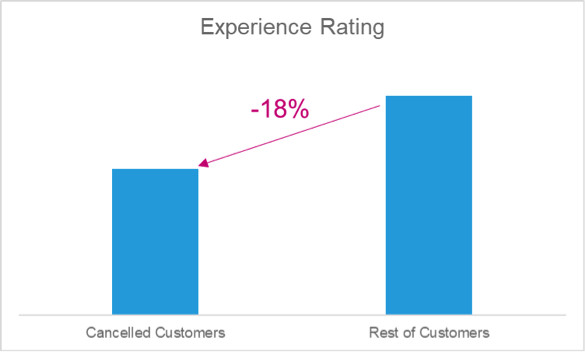

It is important to differentiate between unsatisfied customers who cancelled and customers who cancelled because they wanted to take advantage of the promo. Customers who cancelled after their first payment and rated their experience, have a 18% lower rating than the rest of the customers, enabling the company to identify those unsatisfied customers and incentivize them proactively before they cancel their membership.

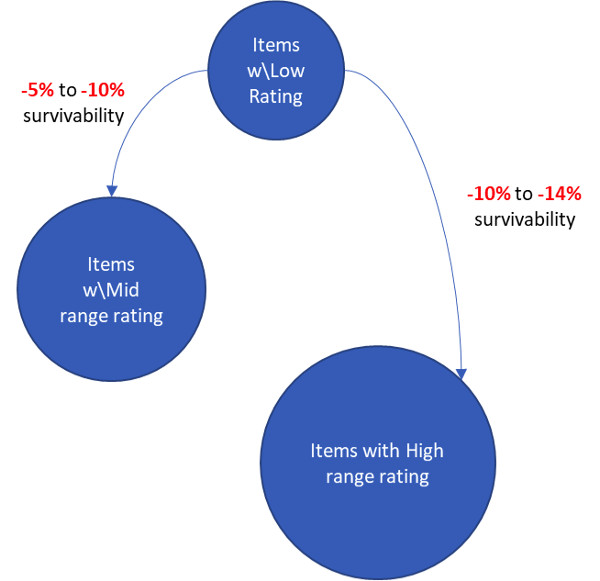

Marketers can proactively identify new customers with a potential risk by relying on the wisdom of the crowd and calculating the average rating of the goods in the initial shipment. If the calculated average of the rating of the goods is on the lower end, the customers have a 5-10% lower survivability (and a 20% lower LTV) than customers who ordered goods with a mid-range rating, and 10-14% lower survivability than customers who ordered goods with a high-range rating.

Rating is a form of increasing engagement with your brand. So encourage new customers to rate their experience after receiving their first shipment, and respond quickly to a negative reviews. Real-time responses may prevent immediate churn.

Other forms of engagement, such as participation in a survey, updating preferences in the platform, or even picking out items for the next shipment, can increase brand loyalty and lifetime value.

Adding a reward program is another fantastic way to encourage additional engagement. It can be as simple as granting points for every rating, shipment, or survey; customers can redeem points later for a discount or a "special surprise" in the next shipment.

3. Active Subscribers

Active Subscribers are those who have received several deliveries; they are familiar with the brand and offerings, and they have an active membership. They are core revenue-generators, so it's important to ensure their satisfaction to prevent churn.

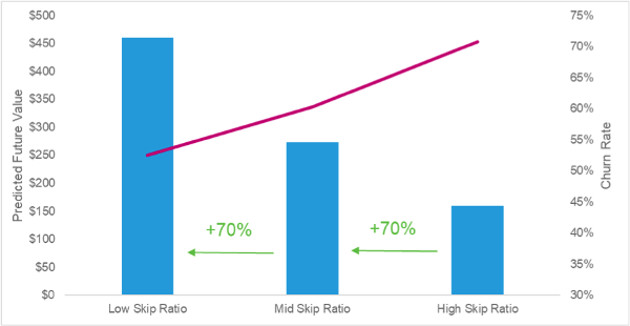

Many active subscribers—around 75%—request to skip a delivery at some point in the membership. We found a direct relationship between the ratio of deliveries skipped and the predicted future value:

(Low Skip Ratio refers to up to 25% of deliveries skipped; Mid Skip Ratio, 25%-50% of deliveries skipped; High Skip Ratio, over 50% of deliveries skipped.)

Those with a low skip ratio have a 185% higher predicted future value and a 25% lower churn rate than customers with a high skip ratio.

Starting a conversation with Active Subscribers might be tricky: Too many messages might cause them to opt out of communications or, even worse, cancel their subscription. However, approaching these customers with the right offers might improve engagement, strengthen the relationship with the customer, and build loyalty.

One option is to use product recommendations, either as an add-on to their next delivery (a great upselling opportunity) or as a method to suggest alternative items they might like. Connecting activity to an upcoming shipment may increase customer awareness and involvement with that shipment, and lengthen their activity as a result.

Another way to increase customer engagement, and thus increase customer longevity, is to use gamified campaigns, enticing the customer to complete a series of actions by offering an incentive as a reward. For example: "Rate your next 5 deliveries and you'll get a surprise in your following box!" This approach can increase customer loyalty and reduce the skipping ratio (e.g., "complete your next 3 consecutive deliveries..."), resulting in a churn decrease and predicted future value increase.

4. Churned Subscribers

Churned subscribers are customers who have canceled their membership or paused their membership for a long duration.

Reactivating churned subscribers is no easy task, and marketers should be cautious about offering tempting incentives to the broad range of churned subscribers or risk negative financial effects. Instead, marketers should focus on sub-groups of churned customers and pair the message or offer with an aspect of their customer experience or activity.

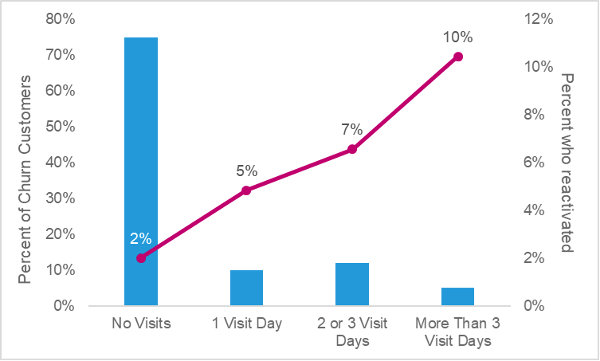

Surprisingly, a substantial proportion (10-25%) of Churned Subscribers without an active membership continue to browse the company website. Former customers who have recently visited the site have a 2.5-5 times higher probability of reactivating their membership. The more they visit, the higher the probability:

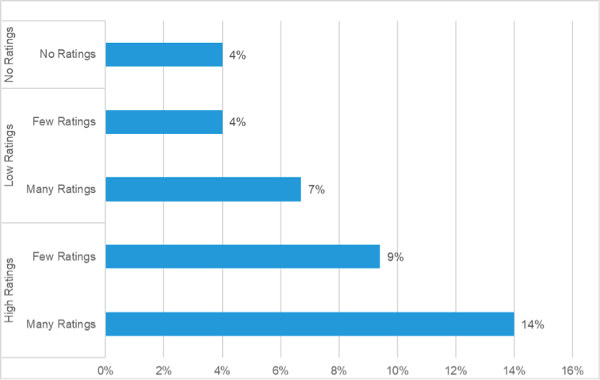

Ratings and reviews have significant importance in identifying churned customers with a higher probability of reactivating. Customers who provided many positive ratings in the past are 55% more likely to reactivate than customers with few positive ratings (14% vs. 9%), and they are 100-250% more likely to reactivate than customers who provided overall negative or neutral feedback (14% vs. 7% and 4%, respectively):

Customers who submitted low ratings should receive a message acknowledging that the company is aware of their lack of satisfaction, and encourage them to give the product another shot. Engaged customers who provided positive feedback should be approached differently, with messaging that focuses on their past satisfaction. And timing is key: Churned subscribers who visit the site should be approached immediately to increase the likelihood of their reactivation.

* * *

A subscription-based model creates both new challenges and new opportunities for marketers. Keeping a positive trend in customer retention requires a data-based understanding of the different personas and consumer behavior associated with them. U sing that data throughout the customer journey is guaranteed to increase loyalty and maximize customer value.