At many companies, Marketing can't match the financially relevant, standardized measurements produced by peers in Finance and Operations.

In fact, among the three primary chief officers of most large companies—the chief finance officer (CFO), the chief operating officer (COO), and the chief marketing officer (CMO)—only the CMO does not use standardized measurements.

That is a big problem. The lack of financially relevant, standardized measurements weakens CMOs' stature.

As Amy Fuller, EVP/Group Executive, Worldwide Consumer Marketing at MasterCard Worldwide, succinctly state at the ANA Integrated Marketing Conference in 2008, "Measurement has always been the problem child in marketing and advertising. It's never been solved. The better we get at integrating things, the less easy it is to isolate specific effects to specific elements of the marketing mix" (see video, Grappling With Integrated Marketing's Metrics Paradox, Ad Age, June 2, 2008).

How Finance and Operations Standardized Their Measurements

The leaders of finance and operations long ago moved past their internecine rivalries, across preferences and even continents, to standardize measurements.

The Great Depression of the 1930s jolted the finance discipline into adopting standards for transparency and accountability, giving rise to Generally Accepted Accounting Principles (GAAP*).CFOs have become so reliant on GAAP that it's hard to imagine doing business any other way.

Similarly, as the industrial society scaled up after World War II, operations leaders reached a series of critical agreements that are in effect to this day. The ISO** came into existence as an international organization to define and codify a broad range of operational descriptions, practices, and measurement.

COOs from all types of industries rely on ISO agreements to efficiently manage their supply chain (which leads to lower costs, and hence higher profit margins) and to ensure consistent quality standards (which retain more customers and so contribute to higher profit margins), among other benefits.

Example Financial Metrics

Focused on High-Return Profit and Growth for a Client-Acquisition Program

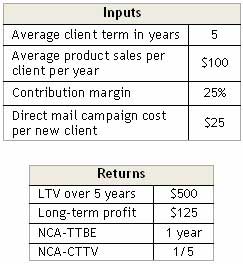

If we look only at the cost of acquisition, first invoice return, or lifetime return, we cannot clearly determine whether any new client is a high-return acquisition. To determine the total value of the marketing investment, our approach must be more holistic than that.

One way is to measure the average value of a new client over the first year of acquisition, and assume (from market research data) the total lifetime value and profitability of each new client.

Measuring the investment to acquire these new clients then becomes a standard exercise (program by program, compared with control groups or hold-out samples).

The next step is to calculate and compare measures such as LTV (long-term value of a customer), NCA-TTBE (new client acquisition time to break-even), and NCA-CTTV (new client acquisition cost to total value).

Additional Scenarios

Assumption: NCA-TTBE=3 years; NCA-CTTV=3/4

Discussion: Three years to hit break-even and only one of four years for incremental profits is marginal at best. This must be a hard marketplace (long sales cycle, little return per new client).

Carefully examine annual retention cost to see whether it exceeds incremental profit, making this new client unprofitable.

This is tight even for luxury items (such as jet airplanes).

Assumption: NCA-TTBE=1/2 year; NCA-CTTV= 1/10

Results: Only half a year to pay back the investment, then nine more cycles of profits. If the retention costs aren't huge, this appears to be a campaign, department, or company with a high rate of financial return.

For Marketing Measurement Standardization, It's All About Financial Profit and Growth

We are chagrined to see marketers still putting forth hundreds, even thousands, of disparate measures for their specialized fields, with most of them stopping short of linking to financial return.

It saps years of progress from the marketing discipline to hear marketing specialists, many at the top of their field, still make passionate arguments that it's all about viewers or listeners or impressions or eyeballs or click-through or brand or awareness or pass-along or engagement, etc.

That trend seems only to be accelerating in the age of digital and social marketing.

These thousands of measurements may have use for daily activity, but when they attract such, well, un-standardized attention, they hurt marketing and they distract CMOs from their main tasks.

It's not all about eye-balls or click-through or brand awareness. It is all about financial profit and growth.

When marketers accept the primacy of profit, they will gain a reputation for delivering high rates of financial return by bringing in valuable new clients and retaining current ones.

If marketers do not begin operating from this perspective and generate standard metrics to prove it, they will continue to give up stature in relation to their peers.

Progress We Should Herald

Many marketing and related associations, such as the American Marketing Association (AMA) and the Coalition for Innovative Media Measurement (CIMM), are already working to standardize marketing measurements. We should herald their progress. And we should insist that their efforts lead to a set of standardized measurements for marketing that...

- Link, ultimately, to financial return

- Apply across industries, countries, monetary systems, etc.

As we make progress on standardized measurements, Marketing's influence will rise accordingly. CMOs will be able to sit at the table with CFOs and COOs—and discuss, in financially relevant, standardized language, how to drive their corporations toward more profit and growth.

*GAAP, Generally Accepted Accounting Principles: The standards, conventions, and rules that accountants follow to create financial statements. Established after the Great Depression, GAAP has grown to become the heart of rational financial decision-making. Many of these standards are required by law (for public companies), and investors and shareholders depend on their permanence and consistency.

**ISO: Iso is not an acronym; rather, it's Greek for "equal," implying a standard across boundaries. It is an international organization that defines and applies standards to thousands of items, as varied as steel pipe threads that must seal by pressure, rules for the abbreviation of titles of publications, and the transliteration of Arabic characters into Roman characters. Without these standards, manufacturing efficiency would suffer, depressing ultimate return on investment and long-term growth.