Marketers love talking about products like the Swiffer or iPod, two colossal successes in terms of brilliance in innovation and new product development. In fact, rumor has it there are more consulting firms taking credit for Swiffer's development and success than can fit into the new Yankee Stadium.

The puzzling question remains: Why aren't there more examples of unabashed new product successes?

To gain insight, we recently implemented a research study exploring the factors that have an impact on a company's ability to succeed in the ever-important CPG growth domain.

Our survey, titled "Creativity in New Products, A Reality Check," queried 128 senior CPG marketers to gauge the challenges they face in growing their businesses as well as the strategies and thought processes they employ.

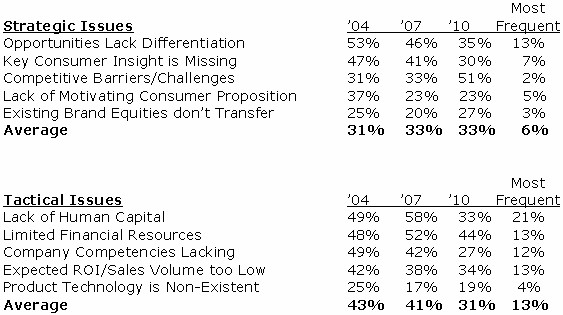

In planning the research, we theorized that new-product development efforts could be influenced by both strategic and tactical elements. Therefore, we developed a list of five strategic and five tactical pitfalls that could limit a company's ability to succeed.

Then, we asked participants to identify those issues that currently challenge them; those they addressed three years ago; those they expect to face three years from now; and which single factor occurs most frequently.

Based on our experience, we hypothesized that strategic issues would be the most relevant causes of new-product disappointment. We were way off base. We learned that, yes, there are strategic issues affecting the outcome of new product activity, but the more relevant issues focus on tactical elements—those things that can be addressed in the short term.

In fact, 63% of survey respondents identified tactical issues as the leading prohibitive factors in the development and launching of new products.

The need to satisfy stockholders (Wall Street) has had a profound effect on our ability to identify, develop, and launch new products as reflected in the lack of human capital, financial resources, and company competencies (another form of human capital). Strategically, we're confident we know where to "place our bets," it's just that financial limitations prevent us from doing it.

The following data illustrate that three of the strategic categories we identified have become less of an issue in the last three years and are expected to become even less relevant over the next three (or at least remain status quo). These include the identification of differentiated opportunities, identification of the key consumer insight, and development of a motivating consumer proposition.

Two issues that will become more relevant to marketers have to do with competitive challenges and the elasticity of brand equities. It appears our own tactical issues have caused a bit of paranoia that the competition is moving faster than we are. And, the research further suggests that brand equities (perhaps our most valuable asset) have reached their breaking point and can't go any further.

Tactically, while all but one factor (the lack of product technology) are expected to decline over time in the amount they can limit our success, several of them are working against higher levels of frustration today, as compared with three years ago.

For example, the lack of human capital and financial resources are more relevant today than they were three years ago, but they are projected to be less relevant in '10 than they were in '04. Why? Because new product development efforts are often disrupted or delayed in order to meet the immediate corporate financial obligation—we're responding to the financial needs of the current quarter.

What are we to do? Well, we're called "managers" for a reason. We need to manage the innovation process so that we can support the best, most promising initiatives, with the limited resources available to us.

And, when possible, convince our management that additional resources are prudent in order to realize the success that the Swiffer and iPod have enjoyed.