No business is an island. The corporate graveyard is full of onetime leading businesses that lost their competitive edge by failing to keep current on their competitors. Think of the classic story of Digital Equipment Corporation, with its once technical superiority turning into organizational chaos, or the various bloated airlines, with cost structures and business models that were vulnerable to competition long before 9/11.

In today's world of accelerated product lifecycles, the instant diffusion of information, and rapid globalization, the competitive landscape is not getting any easier or safer to navigate. As Kotler writes in his well-known textbook, Marketing Management, "markets have become so competitive, understanding customers is no longer enough." Also, in a 2005 McKinsey & Co. article about competition, the authors write, "Plentiful, cheap, and global labor, capital, capacity, infrastructure, and information have affected industries profoundly." In terms of the overall competitive dynamics today, the genie is out of the bottle. There is no going back.

In September 2003, I wrote an article in MarketingProfs about testing one's marketing strategy. I will outline that original model—and extend it, as one way to test your competitive market strategy.

Testing Your Competitive Market Strategy

A famous figure in the world of strategy was a general named Sun Tzu. He lived in northeastern China about 2,500 years ago and was considered an expert in military strategy due to his many victories on the battlefield. Many successful military leaders (such as General Patton) and business executives (such as former GE CEO) have attributed their victories to their application of Sun Tzu's principles.

Sun Tzu wrote about four areas, among others, that we could apply to the testing of marketing strategy: speed, strengths and weaknesses, alliances, and successful market capture. In essence, each of these areas can be compared and contrasted vis-à-vis your competition.

Speed (Velocity)

Market timing and speed are critical to many industries, such as technology, pharmaceuticals, and some consumer goods. Today, in fast-moving areas such as wireless, telephony, and hybrid cars, you can see how market windows open and close relatively quickly. The economic rents accrue to those who can thoughtfully scan the market environment and quickly spot profitable opportunities.

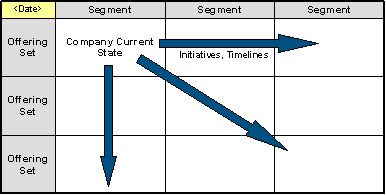

One of the hottest areas in technology and business process today is around predictive analytics, which is all about helping companies to determine their next move and stay one step ahead of the competition. One way to analyze a competitor's strategic intent and migration path is to assess its expansion plans into new market segments and offering sets (see Figure 1). For example, think of Dell moving into printers or Microsoft moving into the CRM space.

Although time-to-market is important, it doesn't mean doing things haphazardly or without some analysis. Often, however, many companies do get stuck in an "analysis-paralysis" loop and don't take action until it's too late. As Jeffrey Pfeiffer, a Professor of Organizational Behavior at Stanford University's School of Business wrote in Business 2.0, "enlightened trial and error [often] outperforms the planning of flawless intellects." Sometimes the application of speed initiatives means dipping a "toe" in the market to see whether you'll get burned or whether you won't—and should therefore jump in.

Strengths and Weaknesses

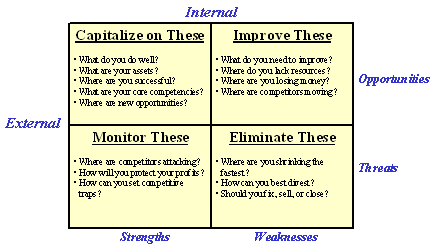

Most people are familiar with a SWOT analysis, which stands for strengths, weaknesses, opportunities, and threats. In the act of completing a SWOT matrix, many companies glean new insights and better understand what they know and don't know. Sun Tzu's key message in this area is to avoid your competitor's strengths and attack their weaknesses.

The following SWOT matrix depicts one way to start asking some hard, strategic questions. As the late Peter Drucker, the well-known management theorist, used to say, the toughest questions to answer are often the simplest ones. For example, where is your company vulnerable to competitors? What business are you really in? Is it worth it to shore up a weak area? What can you capitalize on, improve, or eliminate? What do you need to be monitoring more closely?

There are no silver bullets when it comes to competitive strategy. Like the development of most plans, the benefits of models or frameworks, such as SWOT, often come in the act of completing it, not in the final plan or model. The SWOT process is a good jumping-off point in terms of identifying which areas require a more in-depth, strategic analysis. The resulting strategy should be flexible, anticipatory, and focused, not static.

In a 2005 McKinsey & Co. article titled "Extreme Competition," the authors point to the importance of anticipating the future market landscape. They write:

In many companies, strategy means nothing more than a plan based largely on today's markets, today's product set, and today's competitors and emphasizing the financial forecast. Such a strategy may successfully identify opportunities to capture the upside of the current business over the next few years but can rarely anticipate extreme competition, much less show how to reposition a business to face it. Effective strategy should steer companies toward where an industry is heading, not where it is today.

Alliances

In my original article, I mentioned that Sun Tzu wrote about building a strong web of alliances as a way to decrease the number of attractive or effective moves of your competitors. I provided IBM as an example: It has partnerships/alliances with over 30 application vendors; that helps them to effectively counter almost any direct software vendor attack, considering its broad and comprehensive solution set.

Many alliances are initially consummated around a set of narrow objectives, such as developing a new offering, expanding into new markets or geographies, or blocking a competitor. This focus on a few well-defined and achievable objectives enables the partnership to quickly deliver measurable value, often in contrast to the unrealistic expectations and targets with mergers or acquisitions. For example, a 2002 McKinsey & Co. study of 115 acquisitions in the US. and UK showed that only 23% of transactions earned returns greater than the annual cost of capital required for the acquisitions.

Today, many companies are trying to create competitive advantage by selling "solutions"—to be an end-to-end provider in terms of products and services. In looking at their bundle of capabilities, most companies have to make some important decisions around the three B's: Build, Buy, or Bond. The last "B" is all about alliances and partnerships.

In many cases, alliances are the next best thing to a merger, and often better. Having a set of alliances that help to complement and extend your solution can be a great competitive advantage in the marketplace. Witness the mobile handset alliance a couple of years ago between Sony and Ericsson in order to more effectively attack Nokia and Motorola, two "gorillas" in the space.

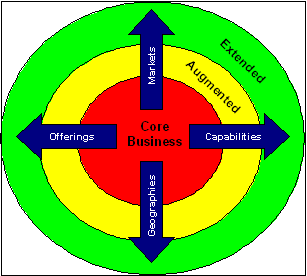

The advantages of alliances can occur at both a company and an offering level. The former area might include an alliance with GE around financing options, which could cut across all offerings, while the latter might be an add-in to a software application that extends its relevancy to more users and systems. An effective alliance strategy can help companies to share costs and risks, better compete against a joint competitor, quickly gain a global footprint, and/or extend the overall capabilities of both organizations. The following figure depicts how companies can augment and extend their footprint across numerous strategic dimensions.

Market Capture

Again, in my original article, I wrote that Sun Tzu's key message is to capture your market in such a way that it is not destroyed in the process, and that this goal can be accomplished in numerous ways, such as pursuing parts of the market that are underserved or using indirect or veiled approaches that will not elicit a competitor's attention or response.

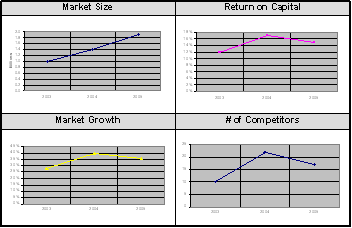

There are many ways to determine the attractiveness of a market, including understanding its size, its growth trends, and its potential. However, regardless of that information, if it's full of strong, deep-pocketed competitors, it may too costly to gain a foothold. The nuance there is that a number of unattractive markets can be profitably exploited through various "disruptions" or innovative business models.

For example, think of the success of Southwest Airlines in the airline industry, one of the least attractive industries in terms of cost structure, with both high hard (airplanes) and soft (pilots) costs and significant amounts of debt to finance it all. As I originally wrote, "early on, Southwest Airlines was often dismissed as not having a robust business model or a traditional hub-and-spoke strategy. [However] It has been wildly successful since its inception by serving the need for low-cost, reliable air travel, and it has achieved this success in such a way as to not engender a competitive response until it was too late to matter."

Even in the fourth quarter of 2005, with the astronomical rise in jet fuel costs, Southwest was able to post a profit that was 50% higher than in the 4Q04. The other low-cost airlines based in the US, JetBlue and AirTran, both posted a loss during the same period. One reason for Southwest's higher profit was that its hedged its fuel costs up through 2009, which seems to be the type of move that is indicative of its company culture: anticipatory, innovative, and focused.

The following mini-dashboard chart is one way to assess a market and begin to identify whether it's attractive to pursue and how it's trending. It could also be used to assess each competitor, with some slight adjustments.

The Best Competitive Strategy

The best competitive strategy is not to directly engage in a fight. Just as in legal disputes, there is often a high risk-adjusted cost in waging price or market-share battles, the same as in litigation. Coopetition, a combination of the words cooperation and competition, has become quite popular in recent years. Many companies understand the vicious cycle of "trading" customers at lower and lower margins in order to gain market share or win on price. As trite as it sounds, a win-win, cooperative approach often creates more value for all parties. As Sun Tzu has written, "The best military strategy, then, is to use superior positioning. After that, use diplomacy. After that, use military force as a threat. Only after all else has failed, attack your enemy."

In terms of designing a competitive intelligence system, it doesn't have to be overly complex. You first need to define the competitive areas that are important—at an offering, market, and company level. Second, make someone accountable for monitoring each area. Third, determine the best sources to collect info—competitor Web sites, trade journals, press releases, financial reports, etc. Finally, create a few pro forma competitive intelligence reports that you can use to evaluate and track trends and material changes.

In the round, the area of intelligence is often fraught with ambiguity and missteps. A few years ago, Malcolm Gladwell, the author of The Tipping Point and Blink, wrote an article in The New Yorker titled "Connective the Dots." It was about some of the paradoxes with American Military Intelligence before and after the 9/11 attacks.

In writing about increased enemy "chatter," and in summing up his article, Gladwell wrote: "We want a prediction. We want to believe that the intentions of our enemies [competitors] are a puzzle that intelligence services can piece together, so that a clear story emerges. But there rarely is a clear story—at least, not until afterward, when some enterprising journalist or investigative committee decides to write one."

It's often said that once a company reaches a certain size, changing its strategic direction is like turning a battleship. It's not a quick process. It's fairly common for firms to do a post-mortem (after something "dies") following a competitive setback or defeat, but it's not so common to do a pre-mortem (before something "dies"). In most firms, pessimists don't usually get promoted, and few people or companies want to write their obituary before they die, as insightful as the exercise might be.