Arguably, the three biggest lies in the world are...

- I'm from the government and I'm here to help you.

- The check is in the mail.

- There is a lot of quick money to be made in developing and emerging (D&E) markets.

While the first two lies are rather easily established (apply for a government concession or call up someone who owes you money), the third one continues to bamboozle large corporations across the globe. In this paper, we seek to focus on the third lie and try to fathom whether there is a grain of truth in it!

The Emerging Opportunity...

After the consolidation wave, consumer packaged goods (CPG) companies are sitting on piles of cash with little opportunity or hope of growth in their traditional product markets. Investment in innovation and new products is increasingly being perceived as high-risk, with a very low success ratio. Faced with an experimental shopper and an aggressive retailer, a number of consumer goods manufacturers are now seeking new pastures to drive growth.

At the Same Time, Technology Has Enabled the Globalization of Supply Chains in Most Products and Services Leading to a Transfer of Wealth and Flow of resources to Geographies with Lower Cost Structures and Abundant Labor pools. A Wave of Economic Revival Is Sweeping Across These Geographies, creating Potentially Lucrative Market Opportunities for Cpg Companies.

...And the Market Reality

Emerging economies of the world are home to 84% of the global population and account for almost half the world's production (PPP) with a going growth rate of 6% as against 2.4% in the developed economies. These regions are home to relatively inexperienced (and apparently, therefore, impressionable) populations and potentially high (though hitherto partially redeemed) purchasing power.

Clearly, this represents a real opportunity if there ever was one.

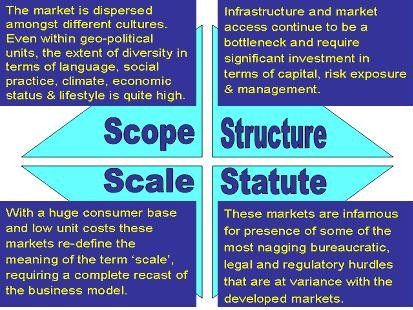

However, some factors make the proverbial low hanging fruits hard to harvest. The figure below seeks to outline these factors.

Figure 1: The 4S Model of D&E Challenge

Entry Strategies

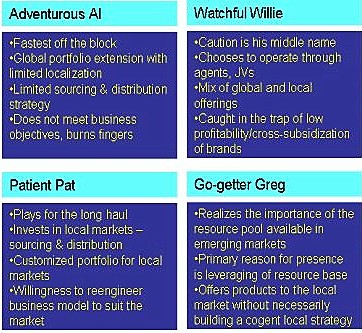

With the caveat of market reality playing at the back of their minds, CPG companies nevertheless seek to reap the benefits of presence in such vast and growing market. Four separate styles of entry into D&E markets are typically discernible. For ease of expression, we have chosen to personify each.

Figure 2: Entry Strategy for D&E Markets

Each of these strategies comes with its own payoffs. It is critical to understand the possibility of aligning each of these to the corporate objectives and weighing the payoffs versus the implied costs.

Born Again

The challenges faced by CPG companies when they are trying to create a foothold in D&E markets are best taken head on by a willingness to reengineer the operating model of the enterprise on some of the following lines:

- The Cost of Revenue

- Knowledge Harnessing and Dissemination

- Distribution and Operations

The Cost of Revenue

Most CPG companies worship at the altar of the simple equation that expresses itself as Cost + Margin = Price. The validity of this equation is put in question by its viability in D&E markets. Organizations that have successfully created a space for themselves in these markets were smart enough to realize this and switched to a more rewarding Affordable Unit Price - Margin = Target Cost.

"Economies of scale" is a mirage in D&E markets due to the intrinsic diversity that demands a large variety across brands, pack sizes, variants, etc. This goes counter to achieving scale. The business model should hence be capable of building efficiencies in an environment where variety drives volumes. Organizations should build capabilities to innovate, formulate, manufacture, distribute, and market a huge basket of options to be able to drive efficiencies and volumes. Incremental top line growth delivered by market entry is typically offset by the growth in overall cost structures.

D&E markets also have a host of native companies that have cornered key resources like talent, trust, real estate, regulatory support, and labor. Acquisition of these critical inputs that are in short supply pushes up costs significantly.

Knowledge Harnessing and Dissemination

Empirical data suggests that categories develop and expand as the markets grow and that different categories start developing at different stages of market growth. Most CPG companies are hamstrung by the limited category learning in the local markets and therefore fail to exploit potentially lucrative opportunities.

One clear way of overcoming this drawback is to revisit the category creation triggers and the conditions that led to the same opportunities in developed markets. These triggers could be of great relevance when trying to understand the opportune moment to create or develop a particular category in D&E markets. Unfortunately, a lot of companies have not institutionalized a knowledge management system that aids an exercise of this nature.

Understanding social trends and shifts in consumer behavior is another key constraint; market knowledge and an understanding of social indicators are key capabilities that need to be harnessed effectively within the organization. This calls for investment in long-term human resource planning to develop local management and talent as attempts to leverage the global pool have mostly failed or have raised discontentment and de-motivation. All-round economic development and a poor human capital development history in these regions put both supply-side and demand-side pressures on the available talent pool.

Distribution and Operations

Unique, customized low-cost distribution networks are critical in markets where retail is fragmented. In developing markets, distribution service providers are not aligned to achieve either reach or specialization. It often falls on the manufacturers to bring in technology, capital, knowledge, and, most importantly, patience, for building an efficient fulfillment organization. To achieve this, sustained capital and effort investment needs to be made—creating fresh cost and resource pressures in the short-to-medium term.

The regulatory environment is another key barrier in the area of distribution and operations as government controls on distribution, retail sector, and transportation are high. With the evolution of trade and the liberalization of government control, the prospects for rapid improvements in these areas high, but manufacturers will still need to invest and take a long-term view to build distribution capabilities.

CPG manufacturing relies on a supply network of interlinked vendors, service providers and raw material suppliers. Factors that affect distribution also impact supply chain and manufacturing. To add to the excitement, commodity trading mechanisms are nascent and unorganized in these markets.

Clearly, with such issues, the only entry strategy of relevance to D&E markets is the one that factors in the long haul and the willingness to effectively build capabilities over the long term. This approach may typically be at variance with the "standard practices" of these CPG companies that are more used to gazing at "fifty-two week horizons."

Such a switch in orientation is unlikely to be an exercise in "dressing up," as half-measures would only limit the ability of the CPG company to exploit the market potential to the fullest—the same extent that makes these markets attractive in the first place. What is really called for is a complete change of religion.

Conclusion: Is It Worth Losing Your Religion?

The jury is still out on that!

- Unilever has chosen to invest in Indian markets through its Indian subsidiary, Hindustan Lever Limited (HLL), over a period of time, and this subsidiary contributes to around 10% of Unilever's worldwide revenue.

- Kraft Foods is conspicuous by its absence in India.

- Cussons walked into India with a plan that is not too obvious and maintains a token presence.

- P&G has explored and changed its operation model in India many times and currently operates through two separate listed entities. Manufacturing and marketing are global and distribution is driven locally.

All these companies are aware of the potential of D&E markets. However, all of them have chosen their own routes to salvation. Given the fact that nothing concrete is changing on the ground, this may continue to be the state in the short-to-medium term.

What stands out clearly is that the attractiveness of D&E markets needs to be judged at the level of each individual organization. Macro-economic indicators might well be economizing on the truth.

Everyone knows that the Sun generates a lot of energy. The question is—do you have the ability, bent, or willingness to harness it?