Though online marketing is still a work in progress for many organizations, most corporate management teams are fully supportive of digital investments, driven by the benefits of improved marketing ROI, stronger customer analytics, and richer online engagement, according to a new report by the Chief Marketing Officer (CMO) Council.

Below, additional findings from the 2012 CMO Council Survey.

Online marketing is still a work in progress

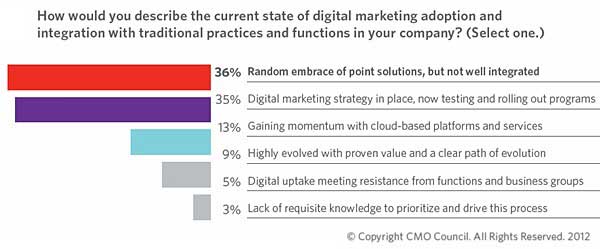

Among senior-level marketers surveyed, only 9% say they've reached a highly evolved and proven digital marketing strategy, whereas a plurality (36%) admit their efforts are a random web of loosely connected and poorly integrated point solutions.

Some 35% of senior-level marketers say they have a strategy in place and are currently testing and rolling out solutions, and 13% are gaining momentum via cloud-based platforms and applications.

Management supports digital marketing, with benefits

Most corporate management teams are supportive of digital marketing efforts.

Among surveyed senior-level marketers:

- 42% say management actively supports digital investments at a line-of-business (LOB) level.

- 20% say marketing has a mandate and budget to execute digital efforts.

- 18% say digital marketing is an agenda item they have to address with their CEO, CIO, and CFO.

- 23% say management is still trying to understand where digital marketing fits in to the business overall.

Management's enthusiasm for digital marketing is influenced the perceived benefits: 63% of senior-level marketers say management is driven to generate increases in marketing performance and ROI via digital channels.

In addition, enthusiasm for digital marketing is also influenced by external drivers:

- 49% of senior-level marketers say management is responding to consumers' preferences for digital media and live, on-demand interaction with brands and companies.

- 51% of senior-level marketers cite the growth of social networks, tablets, and smartphones as a key motivator.

LOB leaders are attracted to rich customer insights via analytics

Particularly enthusiastic about online marketing are LOB heads, who often lead new product launches.

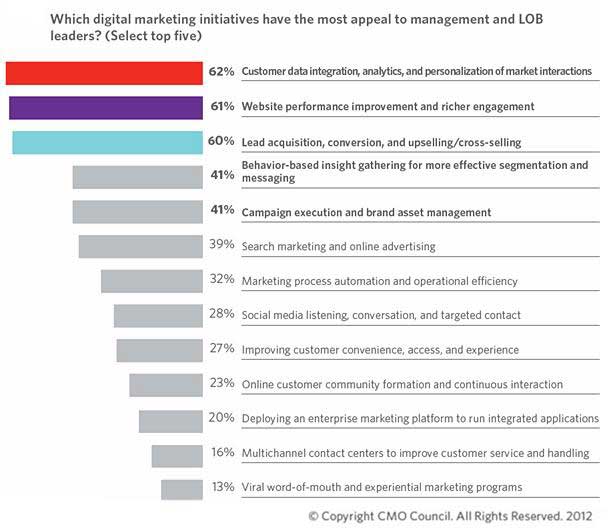

Asked which digital marketing processes and functions have the most appeal, senior-level marketers cite the following:

- Customer data integration, analytics, and personalization of market interactions: 62%

- Website performance improvements and richer online engagements: 61%

- Lead acquisition, conversion, and upselling/cross-selling of customers: 60%

- Behavior-based insights for effective segmentation and messaging: 41%

- Search marketing and online ad optimization: 39%

Email and websites are the top marketing tactics

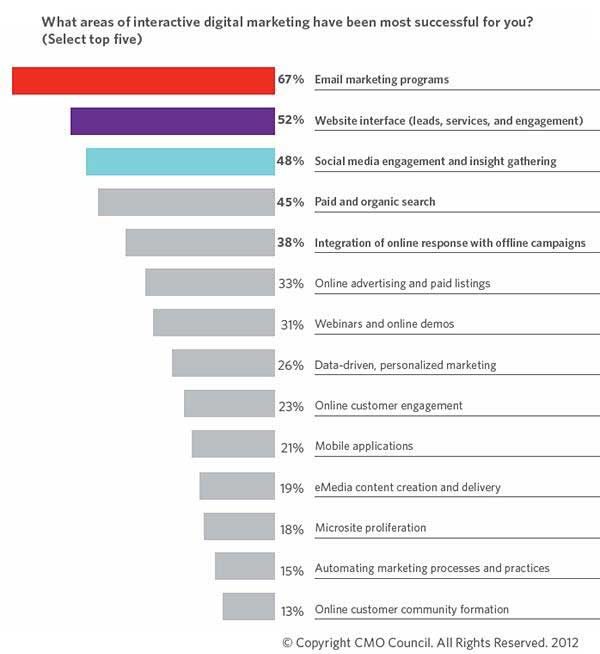

Marketers have been most successful with email marketing efforts (67%), websites (52%), social media engagement and insight gathering (48%), paid and organic search (45%), and in tying together online response to offline campaigns (38%).

Marketers are struggling more with areas such as online customer engagement (23%), data-driven personalized marketing (26%), and marketing process automation (15%).

Social media monitoring is a priority over the next 12 to 18 months

Asked which platforms are likely to be implemented in the coming 12 to 18 months, social media monitoring ranks first (46%), followed by email marketing (38%), Web analytics (39%), and demand-generation programs (33%).

CMOs are assessing digital value via standard metrics

Among senior-level marketers, the top three measurements are standard response rates (55%), self-defined campaign impact and effectiveness measures (52%), and website performance (39%).

Areas lower on the measurement monitor include quality of inquiries (16%), upsell or cross-sell opportunities (10%), WOM buzz (6%), and transactional measures such as e-commerce revenue growth (6%) and market share improvements (7%).

About the data: Findings from the CMO Council study are based on a poll of 250 senior-level marketers in the US, India, Asia-Pacific, Africa, Europe, and the Middle East, conducted in the first quarter of 2012. The respondents span industries such as IT, professional services, retail, financial services, media and publishing, electronics/miscellaneous technology, packaged goods, entertainment, travel and hospitality, energy, and education, among others.