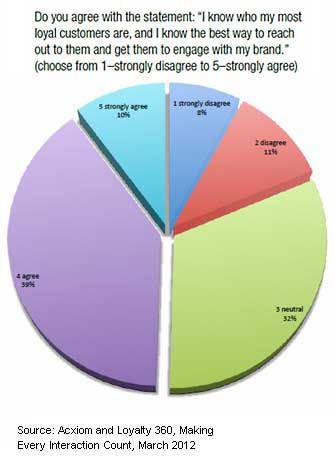

Despite the high cost of acquiring new customers (vs. retaining ones they already have), only one-half (49.6%) of surveyed marketing executives say they know who their most loyal customers are and how best to reach out to them, according to new study by Acxiom and Loyalty 360.

Among surveyed marketing executives:

- Nearly 20% cannot identify their loyal customers (they strongly disagree (8%) or disagree (11%) they know who their loyal customers are and how to engage them).

- Nearly one-third (32%) report their customer knowledge is somewhere in the middle (they're neutral about whether they know who their customers are and how best to reach them).

The cost of acquiring customers typically exceeds the cost of retaining them. For example, Bain Consulting estimates that it costs roughly six to seven times more to gain a new customer than to keep one.

Below, additional findings from "Making Every Interaction Count: How Customer Intelligence Drives Customer Loyalty," a report conducted jointly by Acxiom and Loyalty 360.

Strategies Are Set, but With Limited Success

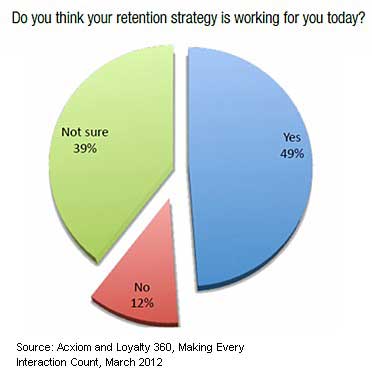

Customer retention strategies have been widely adopted, but with limited success, the study found.

Most (85%) marketing execs say they have some type of customer retention strategy in place, but only one-half (49%) say those strategies are working; 12% of marketing execs don't believe they work at all; and 39% are not sure:

Resource, Budget Allocations Weak

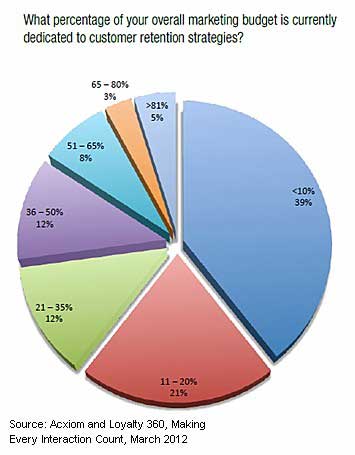

The percentage of staff dedicated to customer retention is low: Fully 70% of marketing execs have less than 20% of their employees devoted to customer retention.

Moreover, fully 60% of marketing execs dedicate less than 20% of their marketing budgets to customer retention:

However, nearly six in ten (57.4%) marketing execs plan to increase their customer-retention spend over the next two years.

Popular Tactics

Rewards programs, social media, and 1-to-1 marketing (personal interactions) are now the most popular tactics used to help brands retain customers:

- 65.2% use social media, and another 23.9% plan to do so in the future.

- 65.2% use rewards programs, and another 8.7% are planning to do so.

- 64.1% use one-to-one marketing tactics, and another 21.7% plan to do so in the future.

Brands are also ramping up mobile efforts: 48.0% of marketing execs have customer retention strategies in place that focus on mobile, and an additional 33.7% are planning to add a mobile component in the future.

Data Collection Issues

Most companies have two interconnected barriers to building customer understanding: Siloed data and competing business units:

- 40.2% access data individually via different lines of business.

- 34.8% report data are centrally located with universal access.

Moreover, 41.3% of marketing execs say database silos are a key challenge to accessing data in their organizations.

However, in addition to data being siloed, companies reported the following bottlenecks:

- Budget limitations: 52.2%

- Lack of IT support: 48.9%

- Insufficient tools: 47.8%

- Not enough know-how/expertise: 34.8%

- Lack of management support: 21.7%

Types of Information Collected

Most (97.8%) marketing executives say they collect basic information such as name, address, and email; 80.4% collect transaction data.

However, data are also collected across a wide variety of customer interactions:

- 73.9% collect customers' mobile phone numbers, and another 15.2% plan to do so.

- 64.1% collect customer feedback/survey data this information and 27.2% plan to do so.

- 44.6% collect demographic data such as household size and income; another 15.2% plan to do so in the future, but 40.2% have no intention of collecting such information.

- 40.2% collect call center interaction data, whereas 33.7% do not, nor do they plan to do so.

Although browsing and search behaviors are currently tracked by a moderate number of companies (43.5% and 31.5%, respectively), an additional 38% plan to start collecting that data—the greatest uptick of any category.

Similarly, only 29.3% now collect social media handles, but 31.5% plan to start doing so.

About the data: Findings are from a survey of 129 marketing executives in B2B (28%), B2C (36%), and both (35%) B2B and B2C markets from a cross section of industries, conducted in February 2012.