When you're facing a lot of competition, one way to understand your situation is to segment the market—because a properly segmented market will give you a better view of the competitive landscape.

It will also help you see whether there are segments that no competitor is targeting. Also, since your competitors probably don't segment their markets—they are trying to target buyers everywhere they can find them—you would be able to see in which segments you could win.

This article will explore segmentation, a highly misunderstood marketing topic.

Segmentation breaks up a market into groups. The original idea of segmentation was that customers within the same group/segment want the same benefits. In addition, segments differ in how critical various benefits are for each segment.

For some reason, however, marketers have settled into simple but wasteful classification systems instead.

What People Get Wrong About Segmentation

Unfortunately, most companies "segment" their market merely by using a category from a list of potentially numerous categories. For example, at a recent Forrester conference I watched an analyst list 22 ways to segment the market, including company size, industry or vertical, growth rate, market position, and so on. The analyst essentially said to the audience, "You figure it out."

B2B marketers, in particular, are often asked to focus attention on "vertical marketing," which refers to an industry, trade, profession, or other groups of customers. The idea is to offer products and services that are specialized to customers in a particular industry.

Many software companies tend to focus on verticals. An example is Guidewire Software Inc., which offers an industry platform (software as a service) for property and casualty insurance carriers in the US and worldwide.

So, let's say you decide to break up the market by verticals. Well, you aren't segmenting the market (I call them classification systems, not segmentation), but you decide to focus on one vertical—let's say it's the healthcare vertical. OK, what does the healthcare vertical care about most? You don't know. So, you start making assumptions and assume everyone in healthcare cares about the same benefits. The problem is that they do not. And, as a result, you start wasting money on trying to communicate to them.

From the perspective of competition, all you see are the competitors who target healthcare. If there are several competitors, you start feeling there is no way to break out of this high-pressure market.

A Better Way to Segment Your Market and See Competition Clearly

If you want to clearly see your competitors in the market, then segment your market on benefits. Doing so will allow you to see where exactly in the market a competitor is playing, and you can see where you may have a distinct advantage.

With benefit segmentation you often get 3-6 different segments. What you often find is that competitors are spread out across all the segments (although they know it since they don't segment the market correctly). Segmenting on benefits gives you an opportunity to focus on segments where you can win.

So, how do you go about segmenting your market? You can use customer data, focus groups, managerial judgment, and even a combination of those approaches.

Let's look at the data route to segmentation.

For the data route, identify a random sample of customers in the market and ask how important each benefit is to them. To get information on the relative importance of benefits and how customers trade them off, be sure to use the 100-point method: That is, take all of the benefits identified in your market and ask customers to allocate 100 points to those most important to them. The more points they assign to a particular benefit, the more critical that benefit is to them. This constant sum is appropriate with less than or equal to 10 benefits.

Alternatively, you can use conjoint analysis, a market research approach that seeks to identify the most significant benefits of respondent choice or decision-making. Be careful when you read about conjoint analysis, however, since many books illustrate the process using features and attributes rather than benefits.

Once you have your data, use a clustering program to segment the data. Clustering programs are available with R, Python, SPSS, SAS, and many other statistical programs. The first thing you will get is a scree plot that indicates how many segments exist, which is a judgment call. The number of segments is a function of three factors: statistical fit (what the empirical data says), what makes the most sense from a managerial point of view, and whether the identified segments can be readily targeted.

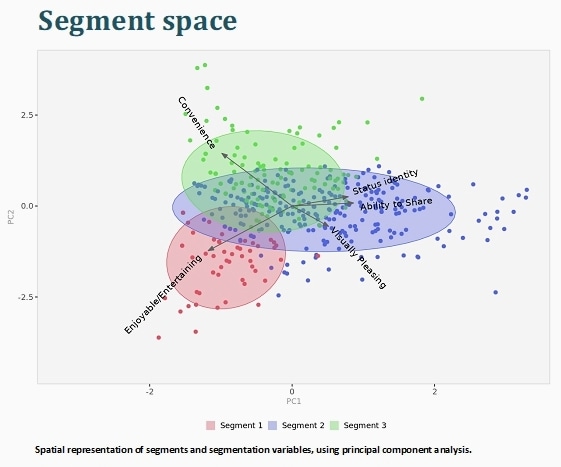

Here is an example of cluster analysis for the home exercise equipment market. Based on the scree plot, three segments were selected. Here is a visual representation:

What the chart shows is that one segment cares mostly about convenience, another segment cares most about having an enjoyable/entertaining experience, and a third segment cares about status identity, the ability to share, and aesthetics (i.e., that the product be visually pleasing).

OK... You've Segmented the Market—Now What?

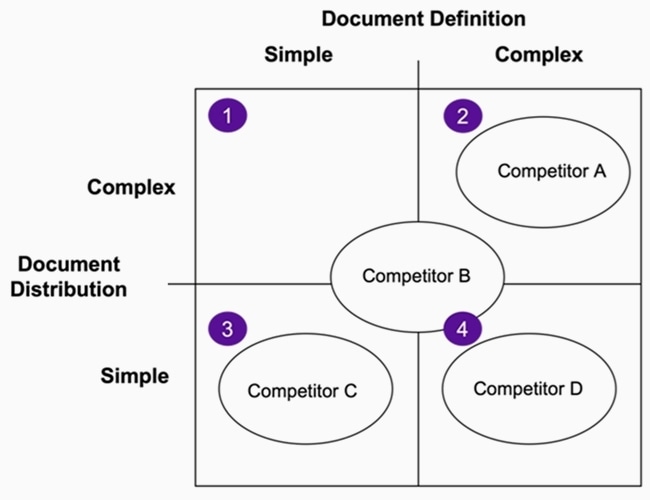

Once you segment the market, you will likely be able to overlay the competitors on the segmentation. Doing so will give you a deeper perspective on precisely where competitors are targeting. Here is the example of a document management company that assumed it was in a crowded market:

You can see there is a segment (number 1) where few competitors focused their efforts.

Here is another quick example. I recently consulted with a machine identity protection company with its effort to segment its market. I worked with a group of about 50 people. Once the members of the group saw the segmentation (a market with six segments), they could clearly see how Amazon was coming into the market—but Amazon was focused on completely different segments than my client.

That view of the market allowed my client to clearly see the nature of the competitive landscape—and it looked much different from a view of the market just broken down by company size or any other classification system.

Differential Advantage Analysis

The reason you want to do differential advantage analysis is that if you find that the benefits line up with your core competencies (more on this in a second), you will be able to fend off competition even in a commodity market.

Once you segment the market, you might find one or two segments where you might be able to compete against the competition. Take the benefits of those two segments, and then consider your company and its strengths. See whether you have strengths that map directly onto the benefits the market cares about.

Even better, you might see whether your company has core competencies. Core competencies are your organization's unique strengths and abilities with specific characteristics (C. K. Prahalad and G. Hamel, "The Core Competencies of the Corporation," Harvard Business Review, Vol. 68, No. 3, 1990, pp. 79-91).

Core competencies are strengths that...

- Provide potential access to a wide variety of markets

- Make it difficult for a competitor to imitate

- Make a significant contribution to the benefits of the product

See whether you have core competencies map directly onto the benefits the market cares about. If you do, you have not only a strong advantage but likely the capability to rise above any competition.

If your company doesn't have strengths or core competencies that map directly into the benefits, then going after a segment that cares about those benefits will be difficult—because offering the benefits won't likely be viewed as credible.

Need Help Segmenting Your Market?

Segmentation is crucial to understanding your competitive market. It helps you find a way out of a very competitive market and it is essential for continued growth.

Need a little help with segmenting your market?

We realize it's not an easy task, and we are here to help. Get in touch and see how we can help you to segment your market.