Eight out of 10 marketers indicate that the need to measure, analyze, and report marketing effectiveness is greater this year than it in previous years, according to the just-released 2009 Lenskold Group/MarketSphere Marketing ROI and Measurement Study.

But six out of 10 marketers don't have the budget necessary to meet this increased need for measurement. In addition, 65% of marketers surveyed report that their CEOs and CFOs are making greater demands than last year to show a potential return on investment (ROI) as part of securing that budget.

Given the prevailing economic conditions, in which marketing budgets are smaller and most companies are expecting a sales decline, that is not entirely a surprise. Executives have higher expectations for accountability and want the limited budget and staff resources invested where they can get the best returns. They question the payback on marketing investments in general and want assurance that they will first be able to meet the company's current financial goals while also managing its long-term financial health.

With marketing teams being challenged to deliver results despite tighter budgets and smaller staffs, how is it possible to improve measurements and ROI analysis now when they did not get addressed in prior years, when more resources were available? We'll draw insights from the 2009 research study mentioned earlier and present opportunities for addressing current pressures for measurements, ROI, and performance improvements.

As our research has found, companies that are already disciplined in marketing measurement and have marketing-operations functions in place are clearly at an advantage in terms of higher marketing effectiveness and efficiency, and greater growth, than their competitors. We can learn some lessons from these top-tier companies and develop a practical action plan.

Opportunities for Measurements and ROI Analysis

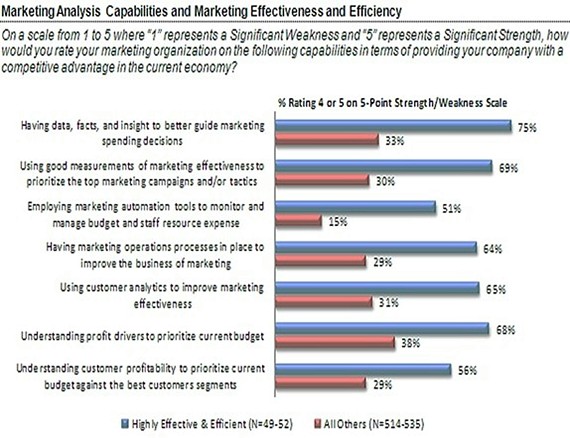

Companies in the study that described their marketing as "highly effective and efficient" possess several strengths that give them a competitive advantage in the current economy.

Compared with all other firms, including those with marketing described as "somewhat effective and efficient," these high-performance firms are more than twice as likely to report strengths in the following areas: having insights, using good measurements, and employing marketing automation tools, as shown in the following figure:

There is good reason to believe that those strengths contribute to the high performance of those companies. In addition, the research found that firms outgrowing their competitors also have greater strengths in many of the same capabilities.

Companies that are under pressure to quickly improve their effectiveness and efficiency should first look at the characteristics of those high-performance firms and then develop a course of action that delivers the insight gained into growth opportunities without draining limited resources.

Here are my top-three priorities for improving measurements and ROI analytics in the current year.

1. Understand profit drivers and project ROI potential

The most significant difference in the strength of capabilities between companies outgrowing their competitors and those with slower growth was found in "understanding profit drivers to prioritize current budget."

Many marketing organizations concentrate on revenue or sales and not on profits, but incremental profits become much more important when you are managing an organization's financial health. With a good understanding of product and service profitability, and customer-segment profitability, marketing organizations can run ROI analyses that align marketing investments with profit potential.

Our research found that 51% of marketers estimate the ROI of marketing initiatives as part of their planning. That number jumps to 81% for the top-tier companies with highly effective and efficient marketing.

Running ROI scenarios in the planning stage can be done with basic spreadsheet tools and a base level of financial data. This is a low-cost initiative that can have an immediate impact on improving profitability as marketers gain insight into the dynamics of profit per sale or per customer relative to sales-conversion rates.

Those scenarios also help the marketing team understand how certain marketing tactics are dependent on additional marketing and sales contacts to ultimately lead to incremental sales. In our experience, estimating ROI scenarios in the planning stage is the most common practice among companies that practice marketing-ROI best-practices, and we repeatedly see clients achieving significant improvements in both incremental sales and cost efficiencies.

2. Leverage current analytics data into customer and sales

In a time of fewer buyers and decreased value per customer, it is critical to tap into customer and sales analytics. Two-thirds of companies with highly effective and efficient marketing report "using customer analytics to improve marketing effectiveness" as a strength (compared with 31% of all other companies). You ultimately need to identify which customer segments continue to make purchases, which are most affected by current conditions, and which are likely to emerge as higher-value segments in the future.

Analytics can run from basic to quite advanced. Targeting is the most significant driver of ROI, and analytics of purchasing behaviors and purchasing trends should be used to prioritize customer segments.

Analytics is one area where companies must consider incremental spending, since incremental sales can be very significant and the payback can come relatively quickly. We are seeing a much higher interest in customer-behavior analyses (factoring in economic impact), forecasting of the marketing impact and sales levels, and predictive modeling. Even with tighter budgets, companies that have held off on this are now taking action.

3. Get basic measurements in place

Executives are asking for better measurements of marketing effectiveness to build confidence in their marketing investments. This does not mean that all marketing initiatives need to be measured.

Marketers need to identify select measurements that will provide new insights with broad application. Measurements that provide insight into the total marketing spend, the level of media support, segment-level analysis of marketing response and sales conversion, total customer value, or key metrics in customer funnel progression can all lead to modifications in strategies that extend across multiple campaigns.

In terms of measurement methodologies, market testing (test vs. control) can be done with reasonable cost and very high accuracy—either for testing within direct marketing or for mass media (where media markets can be treated differently).

We recently designed a measurement plan to help a client determine whether its total media spend was too low and where to shift the budget across media channels. If you are making the argument that budget cuts were too severe, back it up by showing the upside potential.

Investments in Marketing Operations

Marketing Operations enables marketers to perform at a much higher level, which is great for companies that have already invested in campaign-management tools, marketing-resource management, and dedicated marketing operations teams. In fact, our research found that companies with dedicated marketing operations teams were more likely to report highly effective and efficient marketing.

But what can a company do now if that infrastructure is not in place?

There are improvements to market capabilities and the supporting infrastructure that are most essential. The following two areas for consideration, at opposite ends of the resource-requirements spectrum, will give you an idea of how to approach your request for short-term urgencies or long-term opportunities:

1. Access to critical data

Make the case that systems support and technical improvements to provide access to customer, sales, and marketing data residing already within the company are needed now more than ever to improve marketing effectiveness and growth opportunities.

During strong economic times, inefficiencies and decreased effectiveness could still provide reasonable returns. In today's economy, marketing needs to be more precise and must be delivered without waste.

2. Infrastructure investments

Although many companies will shy away from infrastructure investments into new data marts, analytics systems, planning tools, and campaign-management solutions, other companies will determine that now is an ideal time.

Those investments are intended to make marketing more productive once the economy recovers. Companies that can plan to maximize long-term returns can forgo current marketing programs that offer minimal returns in exchange for an infrastructure that will offer significant future returns.

Culture of Discipline and Accountability

Fostering an organizational culture of measurement discipline and accountability can have an immediate impact on the business, leading to increased use of ROI, measurements, and the overall discipline of managing marketing profitability.

"Having the financial and resource support from the executive team to improve our marketing ROI measurement and management capabilities" was a strength for 67% of the companies with highly effective and efficient marketing (compared with 42% of all others). And, as noted earlier, more CEOs and CFOs are requiring Marketing to demonstrate ROI potential.

This is an opportunity that performance-driven marketers should capitalize on to shift capabilities and culture. Make the case for additional marketing and measurement support by running pilot tests and demonstrating the potential impact. Raise concerns over data access and operational barriers to measurements and management of marketing effectiveness. Highlight research that supports the advantages that result from highly effective and efficient marketing.

You want to look for every opportunity to build support for better measurements, either immediately or as marketing budgets recover. Each measurement or pilot should be reinforced as beneficial and providing value to the organization. The goal should be to emerge from the recession stronger and with the resolve to maintain good habits as standard business practice.

* * *

The dot-com boom and bust put ROI on the executive agenda at the turn of the century, and it has generally held steady since. There is reason to believe that there will be positive results from this increased pressure and that it can have a lasting impact as well.

Looking for more research? Check out B2B Marketing in 2009: Trends in Strategies and Spending to see how other firms are allocating their budgets, where they are cutting back and what tactics they'll use this year.