B2B buyers, influencers, and researchers are not simply consuming vendor-related content once and then speeding to make purchasing decisions, according to a recent report from The CMO Council and NetLine.

Rather, most organizations (94%) tend to curate and circulate relevant content internally before purchasing B2B products and services.

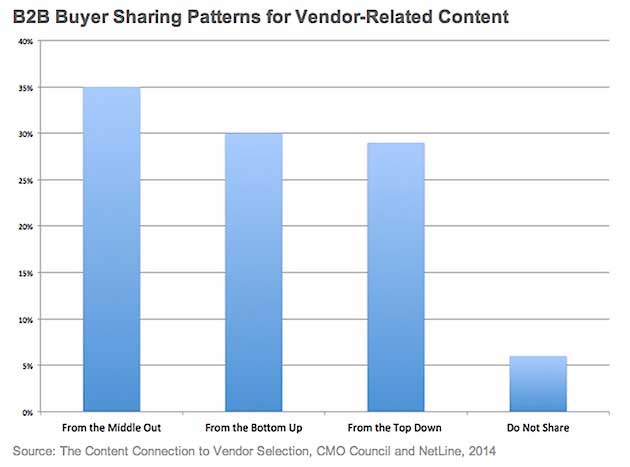

Moreover, that sharing cycle varies widely from organization to organization, the survey of 352 buyers (most from large companies) found. The exact flow is unique to each company, but B2B content sharing within enterprises broadly falls into three distinct patterns, according to the research:

- From the Middle Out: (35% of respondents): Execution-level executives find content about the vendor/product and make the purchase, but senior management is educated about why the decision was made.

- From the Bottom Up: (30% of respondents): Junior or mid-level employees find vendor-related content and share their discoveries with senior management, who then make the final decision.

- From the Top Down: (29% of respondents): Senior managers find the content, then share it with lower-level managers for analysis and final purchase.

Those sharing patterns are being powered by three key personas within the organizations, each with its own behaviors, needs, and expectations, the CMO Council and NetLine found:

- Researchers: Primarily focused on new industry reports/research to inform them of advancements in solutions, trends affecting the markets, and opportunities for improvement.

- Influencers: Interested in both thought leadership found in trusted third-party channels and vendor-branded technology specifications, data sheets, and use cases. This group is the most interested in summarized content, including infographics, videos, and blog commentary.

- Decision-Makers: Want to stay informed through broad research reports and analyst commentary but also expect to have access to detailed data to enable better decision-making at the tail end of the purchasing funnel.

Below, additional key findings from the report.

The Value of Online Content

- 88% of respondents believe that online content has played a major to moderate role in their vendor selection.

- 54% say that it keeps them current on new technologies.

- 38% say that it provides strategic insights and shapes purchase specifications.

- 37% believe that it educates them about issues, problems, and challenges in their industry.

Most Valued Content Types

The top five content types most valued by respondents are the following:

- Research reports and studies (65% value).

- Technical spec sheets and data sheets (50%).

- Analyst intelligence and insight (46%).

- Whitepapers (35%).

- Articles on trade publishing sites (30%).

How They Find Content

- 68% of respondents start their vendor-related content sourcing with search engines and portals.

- 40% go to vendor websites.

- 25% turn to trusted sources or peers.

About the research: The report was based on data from an online survey of 352 B2B buyers, influencers, and researchers conducted in January 2014. Representation across company size included 23% from companies with revenues of more than $1 billion; 10% with revenues between $501 million and $1 billion; 32% between $50 million and $500 million; and 36% with revenues less than $50 million.