When the subject is the relative positioning of competitors across the market landscape, leadership is interested, engaged, and more than willing to debate.

Over the years, I've developed several tools for making that process of analyzing competitive messaging more accessible and empirical (less subjective), as well as more graphical and easier to understand. And it all starts with a straightforward approach to business strategy, giving us the rational basis we need for evaluating marketing messages.

Hundreds of books on competitive messaging have been published in the last decade, each offering a new twist on the subject. My preference, though, has been the well-established approach outlined by Michael Treacy and Fred Wiersema in The Discipline of Market Leaders, which adapts Harvard guru Michael Porter's Five Forces model to market positioning.

Treacy and Wiersema write that there are three "disciplines" companies can embrace in business strategy:

- Product/technology leadership, including the development of cutting-edge innovation and product performance (e.g., Apple)

- Operational excellence, or honing operations to achieve state-of-the-art capabilities in either product purity (e.g., a chemical company) or price (e.g., Walmart)

- Customer intimacy, or the ability to tailor products or services around individual customer needs (e.g., logistics with UPS)

Following Porter's advice, companies seeking to establish their positioning in the marketplace need to select one and only one of those positions. Companies can't, of course, let their services in the other areas become substandard or embarrassing. But they need to ensure they are devoting the lion's share of their resources to furthering their leadership in their chosen market discipline. That, in Porter's view, is the essence of competitive positioning.

How to Position Your Competitors in Four Steps

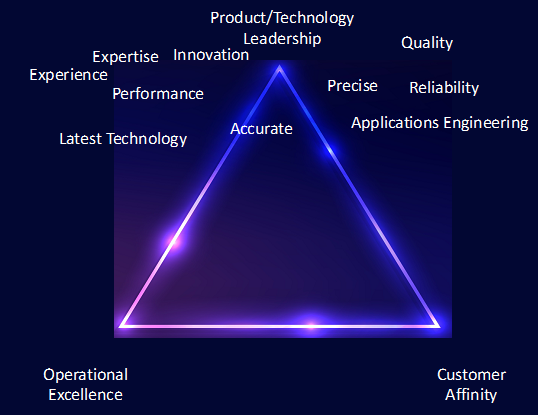

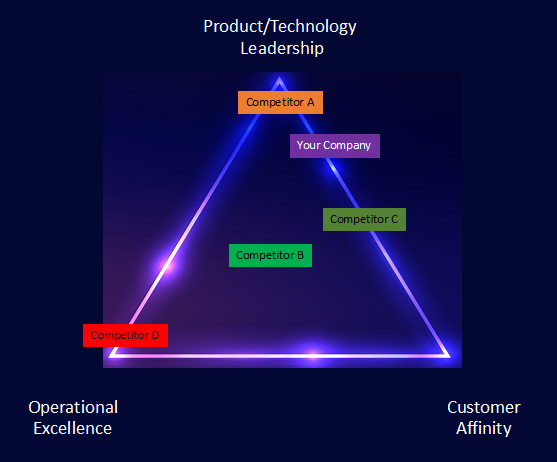

The following pyramid illustrates the "battlefield," if you will, on which the various competitors are arrayed. It lays out the competitive landscape around the three disciplines, creating a "map" we will use to position the players.

1. Assemble your competitor list

The first thing to do is develop a list of competitors to review. Pick the obvious ones, especially the market leaders in sales, reputation, product quality, and customer service; but also think outside the box and consider "not-in-kind competitors" who are just entering the market or obviously could.

Some of the most disruptive market entries over the past few decades have come from low-cost, low-quality market entrants. You don't want to be like the photographic film companies (e.g., Kodak) that wrote off digital photography as being too low-end.

I wouldn't list more than four or five, max.

2. Obtain their marketing materials

The next step, and usually the hardest, is obtaining marketing materials for each competitor. It's best to get emails, ads, or even sales collateral because those often focus on market positioning.

If you have access to competitive ad research companies, such as AdSpyder, SpyFu, and Media Radar, capture ad creative and estimates of advertising spend—a helpful statistic when clients are reluctant to spend as much as they should. Note: Most ad research companies require a subscription for access.

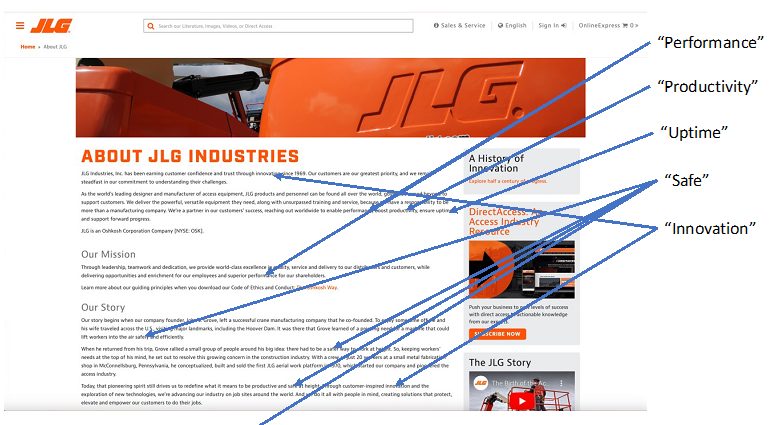

If all else fails, a competitor's websites and social media are adequate resources for analyzing market messaging. When I'm doing high-level branding research, I always look at the following:

- Homepage

- About Us page

- Any "values" pages, if the company has them

- A few product or industry pages

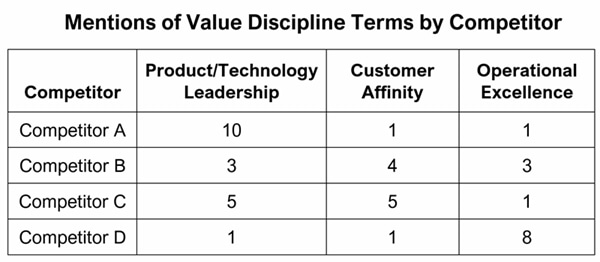

3. Analyze competitors' content

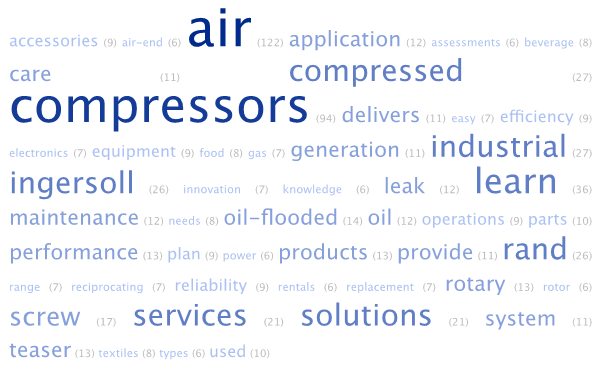

You could run the competitors' sites or key pages through one of the dozens of word cloud generators, such as WordClouds.com. It is certainly fun to use and sometimes shows revealing trends, especially when you use versions that also show the number of times a word is used.

My preference is to capture all the copy on the page, drop it into a Word document, and do searches to count the number of times certain words appear in the copy.

4. Crunch the data

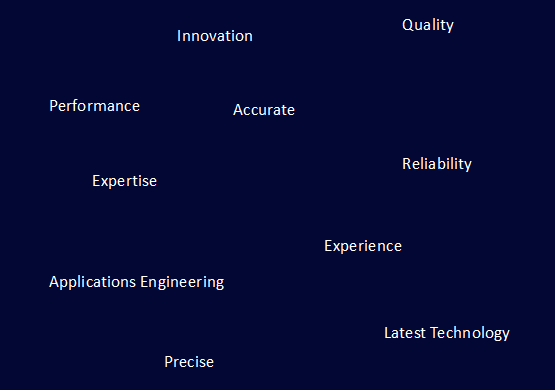

The problem is that writers, the tricky devils they are, use synonyms to avoid repeating certain words and phrases. A typical example of product-technology leadership might be "innovation," and writers might use terms such as "cutting-edge," "advanced," "technology-leading," and others to convey similar ideas or feelings. There are also sub-themes or categories that fall under the relatively broad value disciplines mentioned previously.

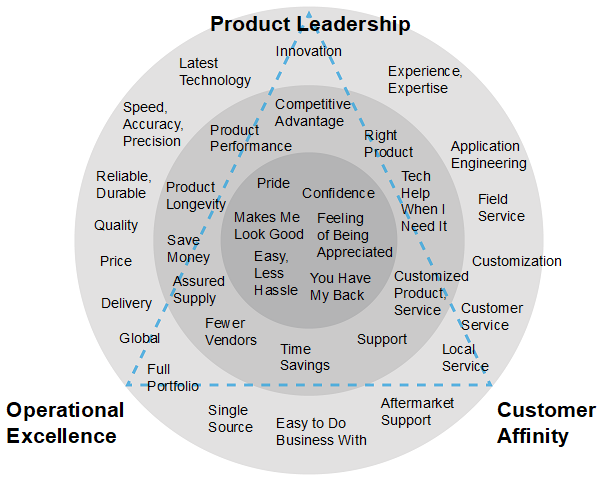

That problem became strikingly obvious on one occasion when a client meeting with 12 people resulted in at least 10 different "positions" being proposed for the company. After a day-long strategy session, our positioning landscape looked something like this:

To fix the problem, I developed a graphic to create a broader semantic view of the value disciplines, grouping words or phrases that are similar or closely aligned: